Stable Government-Leased Office Investment in Harrisburg, PA

Deal Overview

Total Raise

$3.8M

Minimum Investment

$50K

Hold Period

5 Years

LP IRR

20.25%

Return on Equity

2.2x

This property is a single-tenant office building in Harrisburg, PA serving as the main office for Dauphin County Children and Youth.

Investment Highlights

- Long-Term Tenant: Dauphin County has occupied half of the building since 2010 and expanded to the entire building in 2020.

- Client-Facing Services: The building houses essential social services for children and families.

- Tenant Investment: Over $800,000 invested by the tenant in the past five years.

- Strong Cash Flow: 13.91% cap rate with tenant covering day-to-day expenses.

- Increased Budget: Children and Youth department received a budget increase in FY23/24.

- Below Market Renewal: Projected renewal at a 15.39% discount from market rate.

- Strong Credit: Dauphin County has an AA Fitch rating.

- Convenient Location: Close to public transportation.

Meet the Team

MYE PROPERTY HOLDINGS LLC

Michael and Yuval co-founded MY Property Holdings LLC, a real estate syndication business and have since syndicated a single tenant office building in Bridgeport, CT, as well as a 27,000 sf industrial site in 2021. Ethan joined the syndication group in 2022 as counsel and the company changed to MYE Property Holdings. MYE Property Holdings continues to target opportunistic deals, balancing downside protection and profit upside.

MD SQUARED PROPERTY GROUP

MD Squared Property Group was formed in 2014 by Michael Mintz and Dawn Dickstein, both seasoned real estate professionals with over 20 years of experience with a large New York property management firm. MD Squared Property Group now manages over 3,500 units and over 1 million square feet of Office and Retail, across multiple states.

Together, Michael and Dawn have a vision of how buildings should operate and be managed. They started MD Squared Property Group and are building it from the foundation up, looking to establish long-term relationships with clients that share their vision of quality, integrity and accountability. Growth will be managed and buildings will be taken on only as resources permit and never with any compromise in quality of service to existing clientele.

Michael and Dawn believe in service first and foremost. This means servicing resident requests; staff needs and all operational and financial requirements of a building. Beyond service, there is the desire to create value for Buildings and providing a well-run and supportive residential community.

Michael Mintz

Principal

Michael Mintz is the co-founder of MYE Property Holdings LLC and the founder and CEO of MD Squared Property Group, LLC. MD Squared is a 3rd party property management company managing over 120 buildings and 3,000 units with offices in New York City, New Haven, CT and Tulsa, OK. Prior to founding MD Squared in 2014, Michael was a Senior Property Manager and Acquisitions Manager at First Service Residential New York overseeing the acquisition, management, and renovations of over 30 buildings in Manhattan.

Michael has syndicated 12 investments including office-to-residential conversions, mixed-use property re-positioning's and garden style value-add multi-family projects.

Michael has realized strong returns across his deals by focusing on value add opportunities in emerging markets.

Yuval Plattner

Partner

Yuval Plattner is the co-founder of MYE Property Holdings LLC and COO at MD Squared Property, LLC. Yuval is responsible for all syndication, underwriting, and due diligence for MYE Property Holdings.

Prior to moving to New York, Yuval was an Acquisitions Analyst at Decron Properties Corp. overseeing the acquisition of over 1,600 units and $500 million in closings in the West Coast market. Prior to this role, Yuval spent time in all of Decron's divisions developing a broad knowledge in Construction, Marketing, Asset Management, Leasing, and Accounting. Yuval earned his undergraduate degree in Real Estate Development from Baruch College in Manhattan.

Ethan Blinder, Esq.

Counsel

In his role, Ethan primarily focuses on legal and tax structuring as well as financing, acquisition and disposition strategy. In addition to his work with MYE Property Holdings LLC, Ethan is a principal for the Nesor Group and is responsible for the management of a $200+ million-dollar portfolio of residential, commercial and retail real estate.

Ethan is a graduate of Cornell University and Brooklyn Law School where he focused on real estate finance and tax.

Project Financial Details

| Deal Metrics | |

|---|---|

| RSF | 58,007 |

| $/Per SF | $116.80 |

| Occupancy Rate | 100.00% |

| Cap Rate (Going In) | 13.91% |

| IRR (Year 5 Sale) | 20.25% |

| Avg. Cash on Cash | 12.95% |

| MOIC (Year 5 Sale) | 2.20x |

| Uses | At-Closing | $/SF |

|---|---|---|

| Purchase Price | $6,775,000 | $116.80 |

| Estimated Financing Costs | $131,300 | $2.26 |

| Closing Costs | $138,075 | $2.38 |

| Acquisition Fee | $203,250 | $3.50 |

| Due Diligence Costs | $40,150 | $0.69 |

| Escrows | $577,225 | $9.96 |

| Total Uses | $7,865,000 | $135.59 |

| Sources | LTV | LTC | Amount | $/SF |

|---|---|---|---|---|

| Debt (First Mortgage) | 60.00% | 51.68% | $4,065,000 | $70.08 |

| Equity | 40.00% | 48.32% | $3,800,000 | $65.51 |

| Total | 100.00% | 100.00% | $7,865,000 | $135.59 |

Why Harrisburg, PA?

Harrisburg is the capital city of Pennsylvania and the seat of Dauphin County. Located within driving distance of major East Coast cities, the region offers a blend of urban and rural living. A stable workforce is supported by major employers like the Commonwealth of Pennsylvania, Hershey Foods, PinnacleHealth, and others. The area boasts a modern highway system, a renovated airport, and numerous cultural and recreational attractions.

Tenant Overview

Department of Children and Family Services

Dauphin County Social Services for Children and Youth is dedicated to the safety, permanency, and well-being of children and families. They provide essential services including foster care, child abuse prevention, and youth programs. Their vision emphasizes family and community engagement. The department received a budget increase in FY23/24, demonstrating continued support for their mission.

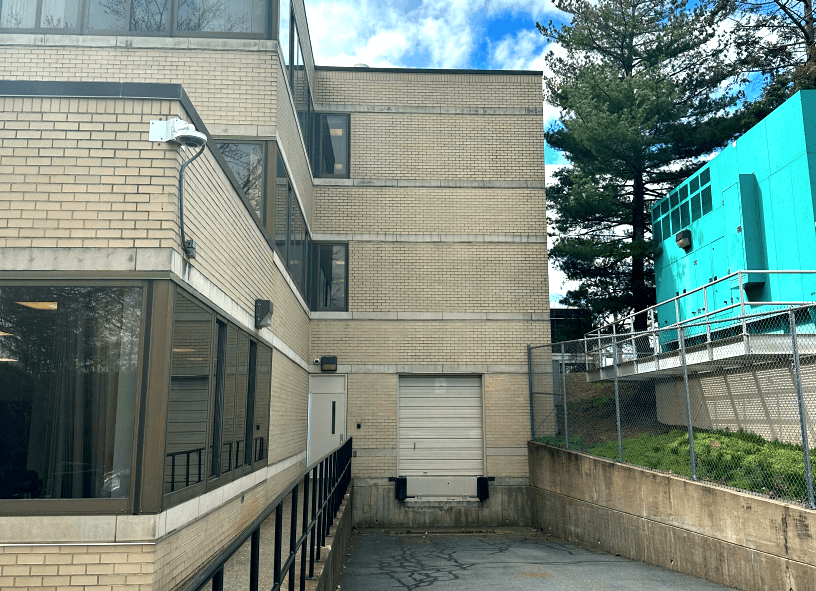

Property Information

| Address: | 1001 N 6th St Harrisburg, PA |

| Building Size: | ± 58,007 SF |

| Site Size: | ± 1.07 Acres |

| Year Built: | 1982 |

| Stories: | 3 |

| Elevators: | 2 |

| Tenancy: | Dauphin County Children and Family Services |

| Parking: | 39 surface spaces and 200 off-site spaces |

| Purchase Price: | $6,775,000 |

| Pro Forma NOI: | $787,320 |

| Year 1 Cap Rate: | 11.62% |

| Occupancy: | 100% |

Previous Acquisitions

| MY Housatonic LLC | |

| Location: | 925 Housatonic Avenue, Bridgeport, CT |

| Asset Type: | Government-Leased Office |

| Building Size: | 57,430 sf |

| Hold Period: | Active (Acquired August, 2021) |

| Purchase Price: | $5,050,000 |

| Projected Returns: | 11.96% Cash-on-Cash, 19% IRR |

| Distributions to date: | $624,247 |

| 2023 Cash-on-Cash: | 15.92% (Annualized) |

| Going-in Cap Rate: | 11.16% |

In a space with fairly limited competition and in a highly saturated multi-family market, MYE Property Partners found value in the government leased asset class. MY Housatonic LLC marked the group's first government-leased acquisition in Bridgeport, CT in August 2021. This acquisition involved intense due diligence into the government-leased market which included hiring a lobbyist from the State of Connecticut, who is still on retainer. The property is 100% occupied with the Department of Social Services as the tenant.

| MYE Fairfield LLC | |

| Location: | 100 Fairfield Avenue, Bridgeport, CT |

| Asset Type: | Mixed-Use Government-Leased Office |

| Building Size: | 115,237 sf |

| Hold Period: | Active (Acquired April, 2023) |

| Purchase Price: | $7,050,000 |

| Projected Returns: | 12.82% Cash-on-Cash, 17.6% IRR |

| Distributions to date: | $200,000 |

| 2023 Cash-on-Cash: | N/A |

| Going-in Cap Rate: | 10.02% |

MYE Fairfield LLC marked the group's second government-leased acquisition in Bridgeport, CT. With the proven concept of the MY Housatonic LLC investment, MYE Property Partners acquired 100 Fairfield at a 10.02% going-in cap rate with a 95% occupancy rate in April 2023. The property is occupied by Department of Children and Families and Department of Mental Health and Addiction Services, both client-facing agencies who serve a large low-income population with high demand for these services. The retail tenants includes a City of Bridgeport Department of Health location, a high-volume Deli, an adoption agency, and local retail operators.

Invest in Stable Government-Leased Office Investment in Harrisburg, PA

Total raise

$3.8M

Min Investment

$50K

Hold time

5 Years

LP IRR

20.25%

Return on equity

2.2x

↓ More details available to qualified investors ↓

Similar Investment Opportunities

Explore more premium deals in our curated collection

The Benton: Class-A Multifamily Near Walmart HQ

$85K committed

The Benton is a strategically positioned 150-unit multifamily housing complex located less than 10 minutes from the new Walmart Corporate headquarters in Northwest Arkansas. This investment opportunity capitalizes on the region's strong economic growth and high demand for quality housing.

Total raise

$8.5M

Min Investment

$100K

Hold time

5-7 Years

LP IRR

19%-22%

Return on equity

1.9 x

Get Notified About New Deals

Leave your email below and we'll notify you when new deals are added.