Multi-Tenant Retail Development: Roanoke Village Pad 1

Deal Overview

Total Raise

$1M

Minimum Investment

$50K

Hold Period

3 Years

LP IRR

20.2%

Return on Equity

1.6x

Invest in Roanoke Village Pad 1, a ground-up multi-tenant retail development in Roanoke, TX, by RVTX Partners, LLC. Seeking $1M LP equity, this project offers a projected 20% XIRR and 1.6x equity multiple over a 3-year hold. Benefit from a pre-leased anchor tenant (D1 Training), prime location in the DFW Metroplex, and experienced sponsorship.

Executive Summary

RVTX Partners, LLC is a joint venture sponsored by three seasoned development firms—Urbana Holdings, MTX Hospitality, and VTP Capital Partners. Investors have the opportunity to participate in the ground-up development of Roanoke Village Pad 1, a multi-tenant retail asset located in the growing market of Roanoke, TX. This project is part of the larger Roanoke Village mixed-use development and seeks $1 million in Limited Partner (LP) equity, which will be complemented by over $830,000 in sponsor equity to fully capitalize the development of Pad 1. With 37% of the leasable area pre-committed to D1 Training and strong tenant demand in the area, this investment offers a compelling risk-adjusted return profile, projecting:

- +20% XIRR over a three-year hold period

- 1.6x Equity Multiple

Roanoke Village Pad 1 represents an attractive opportunity to invest alongside experienced sponsors in a high-growth market with strong fundamentals.

Investment Highlights

- High-Growth Submarket: Located in Roanoke, TX, within the rapidly expanding Dallas-Fort Worth Metroplex.

- Strategic Location: Part of Roanoke Village, positioned between Westlake and AllianceTexas, near major corporate and leisure demand generators.

- Pre-Leased Anchor Tenant: 37% pre-leased to D1 Training, a national fitness brand, providing immediate income upon completion.

- Strong Return Potential: Projected +20% XIRR and 1.6x Equity Multiple over a 3-year hold period.

- Experienced Development Team: Developed by Urbana Holdings, MTX Hospitality, and VTP Capital Partners with over 50 years of collective experience.

- Attractive Financing: Construction financing secured from Happy State Bank, with principal guarantees from Sponsors.

- Value-Add Opportunity: Potential for refinancing and sale to 1031 exchange buyers upon stabilization.

Meet the Team

Sponsor Team - RVTX Partners, LLC

Allan Gutierrez

Principal

Responsible for daily oversight of company operations, evaluating development and acquisition opportunities, geographic and investment expansion, and managing key capital and business relationships.

Ed Nolan

Principal

Responsible for oversight of asset management and investor reporting, acquisition financing, and identifying and underwriting investment opportunities.

Al Karmali

Principal

Responsible for daily oversight of diversified portfolio of companies active in all manners of real estate ownership, development, construction and management.

Tim Nystrom

Principal

Leads daily oversight of company operations with particular attention to development and entitlement matters, as well as management of capital and partner relationships.

David Petersen

Principal

Responsible for oversight of company underwriting, structuring and financing initiatives, as well as ongoing involvement in managing and expanding strategic relationships for the firm.

Property Details

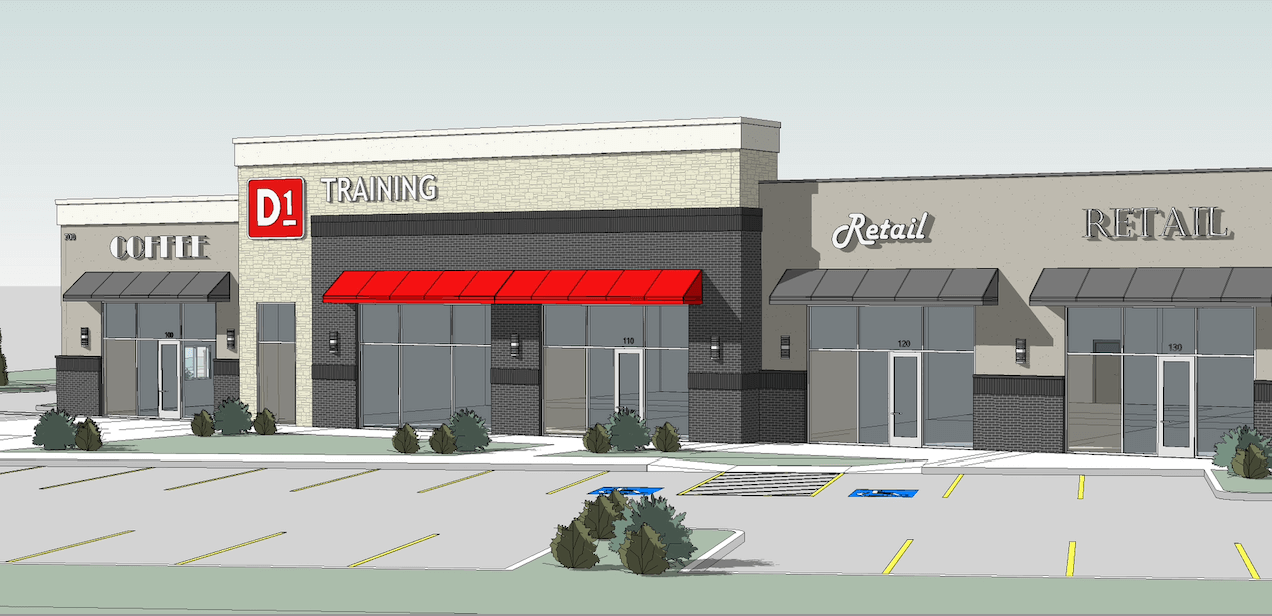

- Property Type: Multi-Tenant Retail Pad (Pad 1 of Roanoke Village)

- Location: Roanoke Village, Roanoke, TX (730 State Hwy 377, Roanoke, TX 76262)

- Building RSF: 11,387 SF

- Pre-Leasing: 37% pre-leased to D1 Training

- Tenancy: Five units planned, including an end-cap unit with drive-thru capability

- Anchor Tenant: D1 Training (elite athlete fitness center)

- Marketing Focus: Targeting retail tenants like Verizon Wireless or small healthcare offices.

- Larger Development: Part of Roanoke Village, a mixed-use hospitality, retail, and medical office center.

Market Analysis

Roanoke, TX, benefits from strong market dynamics within the Dallas-Fort Worth Metroplex:

- DFW Growth: Dallas-Fort Worth is experiencing significant population and economic growth, driving demand in neighboring submarkets like Roanoke.

- Strategic Location: Roanoke Village is strategically positioned between Westlake and AllianceTexas, major employment and residential hubs.

- Pro-Business Environment: Texas and Roanoke offer a favorable investment climate with a pro-business government.

- Strong Retail Demand: North Texas leading the nation in retail development and tenant demand, with low availability rates and increasing rents.

- Corporate Demand Generators: Proximity to AllianceTexas (480+ companies, 55,000 employees), Circle T Ranch (Charles Schwab HQ), and Highway 114 business corridor (major corporations).

- Residential Growth: Migration of residents from Dallas-Fort Worth to northern counties boosting local economy.

Financial Projections

Key Financial Metrics:

- LP Equity Request: $1,000,000

- Total Project Capitalization (Pad 1): $4,537,815

- Projected Equity IRR: 20.2%

- Projected Equity Multiple: 1.6x

- Average ROI: 53.4% over 3-year hold

- Preferred Return: 8.0% annually to Equity Investors

- Targeted Exit Cap Rate: 6.5%

- Projected Sale Price: $500/SF

Sources and Uses of Funds (Pad 1):

| Sources | Amount | % |

|---|---|---|

| Sponsor Equity | $837,815 | 46% |

| Investor Equity | $1,000,000 | 54% |

| Senior Construction Loan | $2,700,000 | 60% |

| Total Sources | $4,537,815 | 100.0% |

| Uses | Amount | % |

|---|---|---|

| Purchase Price (Land Contribution) | $1,652,746 | 36.4% |

| Construction Costs | $1,544,126 | 34.0% |

| Initial Leasing Costs (TI/LC) | $784,598 | 17.3% |

| Other Costs & Reserves | $556,345 | 12.3% |

| Total Uses | $4,537,815 | 100.0% |

Location Highlights

Roanoke Village Pad 1 benefits from a prime location within Roanoke Town Center, offering:

- Roanoke Town Center: Heart of Roanoke, TX, with walkability to downtown restaurants, shops, and entertainment.

- Proximity to Major Developments: Near AllianceTexas (26,000 acres, 480+ companies), Circle T Ranch (Charles Schwab HQ), and Highway 114 business corridor.

- Corporate Demand: Located in the growth path of the Westlake/Southlake financial services quadrant, attracting businesses and employees.

- Accessibility: Situated on Highway 377, with easy access to Northwest Parkway 114, Alliance Gateway Freeway 170, and I-35W.

- High Traffic Location: Excellent visibility and accessibility on a major thoroughfare.

- Growing Residential Area: Surrounded by expanding residential communities in Roanoke and neighboring cities.

Project Timeline

- Land Acquisition: Completed July 2022 (for Roanoke Village site)

- Pre-Leasing: Ongoing, 37% pre-leased to D1 Training

- Construction Financing: Secured from UMB Bank on September 30th

- Construction Start: October 2025

- Stabilization: Anticipated within 18 months of construction completion

- Hold Period: 3 Years

Why Invest

Investing in Roanoke Village Pad 1 offers compelling advantages:

- Attractive Returns: Projected 20% XIRR and 1.6x equity multiple provide strong returns.

- Experienced Sponsorship: Urbana Holdings, MTX Hospitality, and VTP Capital Partners bring a strong track record.

- Strategic Asset Class: Retail sector benefiting from a return to brick-and-mortar and strong tenant demand in North Texas.

- Favorable Entry Basis: Sponsor's attractive land basis and pre-development work reduce risk.

- Recession-Resistant Market: Dallas-Fort Worth MSA and Roanoke submarket demonstrate resilience and growth potential.

- Value Creation Opportunity: Ground-up development allows for value creation through lease-up and strategic exit.

- Alignment of Interests: Significant Sponsor co-investment aligns interests with LP investors.

Invest in Multi-Tenant Retail Development: Roanoke Village Pad 1

Total raise

$1M

Min Investment

$50K

Hold time

3 Years

LP IRR

20.2%

Return on equity

1.6x

↓ More details available to qualified investors ↓

Similar Investment Opportunities

Explore more premium deals in our curated collection

Barn & Basket Market: Modern Neighborhood Grocery Opportunity

$0 committed

AVGI presents Barn & Basket Market, a modern neighborhood grocery concept focused on fresh food, convenience, and everyday affordability. Located at 154 Waverly Avenue in Patchogue, New York, this 20,000-square-foot facility sits on a prime 1.64-acre site in a supply-constrained market with high barriers to entry.

Total raise

$5M

Min Investment

$100K

Hold time

5 Years

LP IRR

15.2%

Return on equity

1.9 x

The Glass House: High-Yield Short-Term Luxury Rental

$0 committed

AVGI Equities presents a unique opportunity to participate in the acquisition of "The Glass House," a 10,000-square-foot architectural trophy estate located in the ultra-affluent market of East Hampton, NY. This investment targets a high-yield, short-term luxury rental strategy in one of the most supply-constrained resort markets in the United States.

Total raise

$2.5M

Min Investment

$250K

Hold time

5 Years

LP IRR

16.6%

Return on equity

2.0 x

Stabilized ‘Class A’ Asset – 59 LP Investor A-Units for purchase

$0 committed

Located on the prominent intersection of Van Buren and Juneau, NOVA is a 9-story, 251-unit luxury apartment community in the heart of Milwaukee's East Town opened in 2023. The project brought new construction luxury product to a submarket that had not seen an approachable price point in over a decade.

Total raise

$1.01M

Min Investment

$300K

Hold time

7 Years

LP IRR

17.4%

Return on equity

2.1 x

The Approach: Class A Multifamily

$0 committed

The Approach is a Class A, 318-unit multifamily development located in Westfield, Indiana — one of the fastest-growing cities in the state and a leading market for multifamily investment. Investors are projected to receive a 25% internal rate of return (IRR) over the three-year investment period, with an equity multiple of 1.9x.

Total raise

$6M

Min Investment

$250K

Hold time

3 Years

LP IRR

25%

Return on equity

1.9 x

The Benton: Class-A Multifamily Near Walmart HQ

$85K committed

The Benton is a strategically positioned 150-unit multifamily housing complex located less than 10 minutes from the new Walmart Corporate headquarters in Northwest Arkansas. This investment opportunity capitalizes on the region's strong economic growth and high demand for quality housing.

Total raise

$8.5M

Min Investment

$100K

Hold time

5-7 Years

LP IRR

19%-22%

Return on equity

1.9 x

Stable Government-Leased Office Investment in Harrisburg, PA

$3.8M committed

This property is a single-tenant office building in Harrisburg, PA serving as the main office for Dauphin County Children and Youth.

Total raise

$3.8M

Min Investment

$50K

Hold time

5 Years

LP IRR

20.25%

Return on equity

2.2 x

Get Notified About New Deals

Leave your email below and we'll notify you when new deals are added.