Portland's Belmont Middle Housing: High-Return Multifamily

Deal Overview

Total Raise

$1.5M

Minimum Investment

$50K

Hold Period

5 Years

LP IRR

17%

Return on Equity

1.9x

True Communities’ ground-up, Class A, boutique multifamily development in Portland, Oregon, adds 25 market-rate units to the city’s highly desirable Belmont neighborhood. The investment directly caters to the housing demand in this walkable, amenity-rich area near major employment centers.

Investment Highlights

This offering by True Communities is an opportunity to invest in the ground-up development of a Class A, market-rate multifamily project located at 3114 SE Belmont Street in Portland, Oregon. The project is designed to address unmet housing demand in a highly desirable and supply-constrained neighborhood. Key investment highlights include:

- Strong Investor Returns: True Communities is targeting an 17% Leveraged Internal Rate of Return (IRR) for investors, and a 11% Unleveraged IRR demonstrating inherent profitability.

- Attractive Equity Multiple: the targeted investor Equity Multiple is 1.85x, meaning for every dollar invested, investors would receive $1.85 upon exit ($0.85 in profit for every dollar invested).

- Solid Initial and Stabilized Yields: The development is underwritten to deliver a strong initial Untrended Yield on Cost of 6.1% (NOI to total project cost ratio), increasing to 7.1% upon stabilization. This highlights the property's capacity for immediate and growing cash flow generation.

- Conservative Underwriting: Financial projections are based on a conservative 5.50% Exit Cap Rate*, providing a buffer against potential market fluctuations and demonstrating a realistic approach to valuation and return expectations.

- Strategic Housing Focus: The 25-unit property is designed to cater to an underserved market segment in Portland at the neighborhood level, offering a desirable housing option in a location known for its strong rental demand and limited new supply of this type of product.

These key financial metrics, combined with the strategic location and asset class, position this project as a highly attractive investment opportunity within the Portland multifamily market.

* The project will benefit from a 100% property tax abatement on the entire building for 10 years after completion, in exchange for providing two income-restricted units. Therefore, the exit valuation will depend in part on negotiations with buyers with respect to the value of the remaining term of the 10-year property tax abatement at the time of sale.

Meet the Team

The 3114 SE Belmont Street is led by a seasoned team of real estate professionals with extensive experience in development, construction, property management, and finance. Their vertically integrated approach and deep understanding of the Portland market are key drivers of the project's strategy and projected success. Key members of the team include:

Eric Jacobsen - Founder and CEO

As the Founder and CEO of the True Communities Group of Companies, Eric Jacobsen brings over 37 years of experience in real estate development and operations.

Lance Leland - Chief Operating Officer

Lance Leland, as COO, brings over three decades of experience in the rental housing business, including significant expertise in revenue optimization and expense management. His focus on operational efficiency is crucial to the project's profitability.

Dan Muresan - VP of Development/Construction President

Dan Muresan serves as the President of JF Construction Company, a key affiliate within the True Communities Group. With over 25 years of experience and a portfolio of over 1,500 completed construction projects, Dan oversees all aspects of project development and construction.

This experienced and dedicated team provides a strong foundation for the successful execution of the 3114 SE Belmont Street development.

Why Portland, OR?

Portland, Oregon consistently ranks as one of the most desirable cities in the Pacific Northwest, and for compelling reasons. Its vibrant culture, strong economy, and commitment to sustainable urban living create an ideal environment for multifamily real estate investment. Key factors making Portland an attractive market for this project include:

- Thriving Urban Core: Portland is the sixth-most populous city on the West Coast, boasting a dynamic urban environment with a high degree of walkability, extensive public transportation options, and over 10,000 acres of public parks. This urban fabric is highly attractive to the target demographic.

- Robust Tech-Driven Economy: Portland's economy is increasingly driven by a strong technology sector, alongside established corporate presences and a vibrant local culture. This economic engine attracts in-migration of skilled professionals seeking quality housing options.

- Strong Housing Demand: As highlighted in the investor deck, there is a significant and growing demand for housing options in walkable, high-resource urban neighborhoods like Belmont Street. This demand is fueled by demographic shifts and a preference for urban living with a suburban feel, a niche that 3114 SE Belmont is specifically designed to fill.

- Anticipated Rent Growth: The Portland market is projected to experience a rise in market rents due to increased average median income,increased barriers to home ownership and continued in-migration coupled with a decline in new multifamily construction starts. This supply and demand dynamic creates a favorable environment for rental rate appreciation at 3114 SE Belmont Street.

- #22 National Multifamily Market Ranking: Portland's multifamily market is recognized nationally as a strong performer, ranking in the top 25 of the National Multifamily Index (NMI) due to declining vacancy rates and continued household growth. This external validation underscores the market's stability and investment potential.

Investing in 3114 SE Belmont Street provides exposure to a resilient and growing multifamily market within a city that is consistently recognized for its quality of life and economic dynamism.

Project Overview

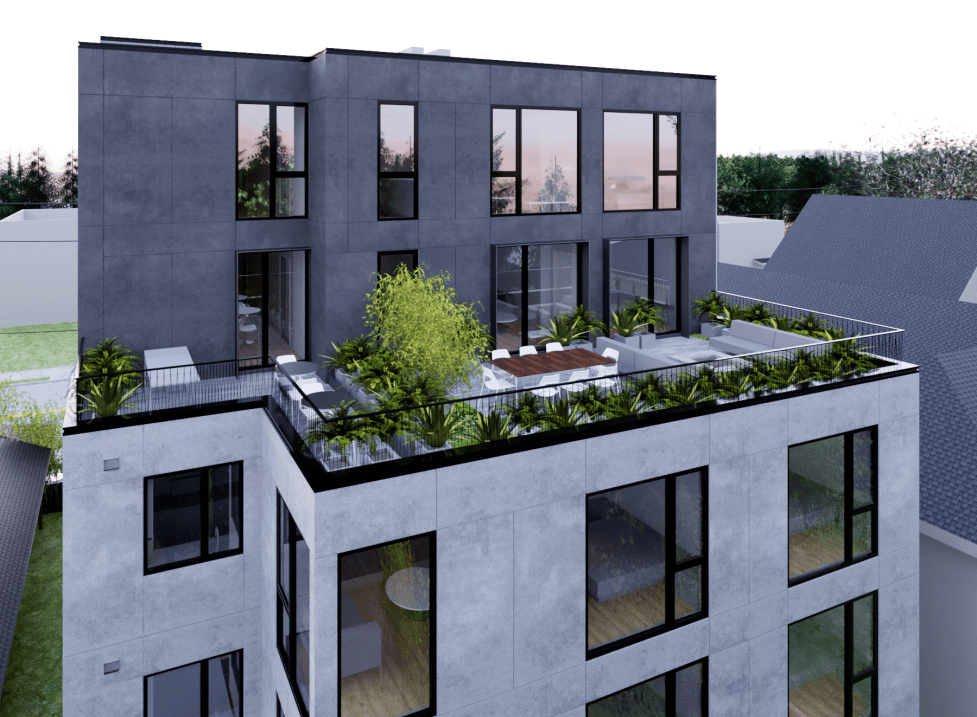

3114 SE Belmont Street is a newly developed, Class A market-rate multifamily property designed to offer modern urban living in Portland's desirable Belmont neighborhood. This boutique 25-unit building provides an attractive investment opportunity focused on compelling macro demographic trends driving multifamily demand in Portland. Key project details include:

- Property Address: 3114 SE Belmont Street, Portland, OR

- Property Type: Market Rate Multifamily - New Construction

- Asset Class: Class A

- Total Units: 25 Units

- Studio Units: 12 (48% of total) - Average Size: 359 SF

- One-Bedroom Units: 11 (44% of total) - Average Size: 584 SF

- Two-Bedroom Units: 2 (8% of total) - Average Size: 719 SF

- Building Height: 5 Stories

- Average Unit Size (Blended): 487 SF

- Gross Building Area (GSF): 17,275 SF

- Net Rentable Area (NRSF): 12,167 SF

- Parking: Bicycle Storage for 22 Bikes

- Anticipated Completion/Lease Start: Q2 2024 (Targeted for June)

- Target Stabilization: Q2 2025

Architectural design renderings and unit floor plans are available within the document.

Why This Investment?

The 3114 SE Belmont Street development represents a strategically targeted investment opportunity within Portland's thriving multifamily landscape. Beyond the attractive market fundamentals, this project offers specific advantages that make it a compelling investment:

- Housing Focus in Prime Location: The project directly addresses an underserved housing segment with a well-designed 25-unit building on SE Belmont Street, a highly sought-after location known for its walkability, amenities, and proximity to employment centers. This targeted approach positions the property for strong tenant demand and occupancy.

- Class A, Boutique Multifamily Offering: In a market where Class A multifamily product is in demand, 3114 SE Belmont Street delivers a newly constructed, high-quality building designed to attract discerning renters seeking modern amenities and urban convenience. This superior product quality enhances its competitive position and rent potential.

- Optimized Unit Mix for Target Market: The unit mix, heavily weighted towards studios (48%) and 1-bedroom units (44%), is specifically tailored to the demographic driving demand for this type of housing – single professionals, young couples, and downsizing individuals seeking efficient and well-located living spaces. This unit mix strategy maximizes appeal and lease-up potential.

- Strong Projected Financial Performance: The investment is underwritten to deliver compelling project-level returns, including a 18.7% Leveraged IRR and a 1.97x Equity Multiple. These robust projections, based on conservative assumptions, demonstrate the project's inherent profitability and potential for significant investor returns.

- Experienced Development and Management Team: The 3114 SE Belmont Street team, with its proven track record in Portland and vertically integrated structure encompassing development, construction (JF Construction), and property management (Jacobsen Real Estate Group & Seasons Living), brings the expertise and local market knowledge necessary for successful project execution and operation.

By focusing on housing in a prime Portland location, combined with strong financial projections and an experienced team, 3114 SE Belmont Street offers a unique and attractive investment proposition.

Partnership Structure

Equity Contributions:

| General Partner | 10% of required equity to be contributed by True Communities |

| Limited Partner | 90% of required equity to be contributed by investors |

| LP Preferred Return: | 8% (non-compounding) |

| IRR Hurdles: | None |

| GP Promoted Interest: | 20% (i.e. 80/20 split after LP achieves 8% return) |

| Total LP Distributions | $3,509,178 |

| Total LP Contributions | $1,898,488 |

| Total LP Profit | $1,610,690 |

| LP IRR | 16.8% |

| LP Equity Multiple | 1.85x |

Sources and Uses

| Sources | Amount | % |

|---|---|---|

| Construction Loan | $4,150,000 | 66% |

| Equity | $2,109,431 | 34% |

| Total Sources | $6,259,431 | 100% |

| Uses | Amount | % |

|---|---|---|

| Land | $864,182 | 14% |

| Hard Costs | $4,108,607 | 66% |

| Soft Costs | $757,092 | 12% |

| Financing, Reserves, Closing | $369,550 | 6% |

| Contingency | $160,000 | 3% |

| Total Uses | $6,259,431 | 100% |

Proven Track Record

True Communities is led by seasoned experts with a demonstrated history of success in real estate investment and development. Having navigated multiple investment cycles, the team has consistently delivered compelling returns, evidenced by their fully cycled and currently managed investments. This track record provides investors with confidence in the team's ability to execute the 3114 SE Belmont Street project and achieve projected returns. Highlights from their track record include:

Fully Cycled Investments:

| Name | Completed | Type | Size (SF) | Units | YOC | Equity Multiple |

|---|---|---|---|---|---|---|

| The Katniss | 4/29/2020 | Multifamily/Retail | 32,762 | 30 | 5.68% | 1.75x |

| Greeley II | 11/2/2023 | Multifamily | 7,249 | 13 | 6.69% | 1.25x |

Currently Managed Investments (Selected Examples):

| Name | Completed | Type | Size (SF) | Units | Stabilized NOI | YOC | Equity Multiple* |

|---|---|---|---|---|---|---|---|

| Overlook 2730 | 2/8/2017 | Multifamily/Retail | 21,280 | 25 | $337,706 | 7.14% | 2.64x |

| Greeley I | 5/19/2023 | Multifamily | 6,719 | 14 | $165,436 | 6.70% | 1.25x |

| Wheelhouse II | 2/14/2024 | Multifamily/Retail | 20,846 | 31 | $372,362 | 7.01% | 1.65x |

Invest in Portland's Belmont Middle Housing: High-Return Multifamily

Total raise

$1.5M

Min Investment

$50K

Hold time

5 Years

LP IRR

17%

Return on equity

1.9x

↓ More details available to qualified investors ↓

Similar Investment Opportunities

Explore more premium deals in our curated collection

Barn & Basket Market: Modern Neighborhood Grocery Opportunity

$0 committed

AVGI presents Barn & Basket Market, a modern neighborhood grocery concept focused on fresh food, convenience, and everyday affordability. Located at 154 Waverly Avenue in Patchogue, New York, this 20,000-square-foot facility sits on a prime 1.64-acre site in a supply-constrained market with high barriers to entry.

Total raise

$5M

Min Investment

$100K

Hold time

5 Years

LP IRR

15.2%

Return on equity

1.9 x

The Glass House: High-Yield Short-Term Luxury Rental

$0 committed

AVGI Equities presents a unique opportunity to participate in the acquisition of "The Glass House," a 10,000-square-foot architectural trophy estate located in the ultra-affluent market of East Hampton, NY. This investment targets a high-yield, short-term luxury rental strategy in one of the most supply-constrained resort markets in the United States.

Total raise

$2.5M

Min Investment

$250K

Hold time

5 Years

LP IRR

16.6%

Return on equity

2.0 x

Stabilized ‘Class A’ Asset – 59 LP Investor A-Units for purchase

$0 committed

Located on the prominent intersection of Van Buren and Juneau, NOVA is a 9-story, 251-unit luxury apartment community in the heart of Milwaukee's East Town opened in 2023. The project brought new construction luxury product to a submarket that had not seen an approachable price point in over a decade.

Total raise

$1.01M

Min Investment

$300K

Hold time

7 Years

LP IRR

17.4%

Return on equity

2.1 x

The Approach: Class A Multifamily

$0 committed

The Approach is a Class A, 318-unit multifamily development located in Westfield, Indiana — one of the fastest-growing cities in the state and a leading market for multifamily investment. Investors are projected to receive a 25% internal rate of return (IRR) over the three-year investment period, with an equity multiple of 1.9x.

Total raise

$6M

Min Investment

$250K

Hold time

3 Years

LP IRR

25%

Return on equity

1.9 x

The Benton: Class-A Multifamily Near Walmart HQ

$85K committed

The Benton is a strategically positioned 150-unit multifamily housing complex located less than 10 minutes from the new Walmart Corporate headquarters in Northwest Arkansas. This investment opportunity capitalizes on the region's strong economic growth and high demand for quality housing.

Total raise

$8.5M

Min Investment

$100K

Hold time

5-7 Years

LP IRR

19%-22%

Return on equity

1.9 x

Stable Government-Leased Office Investment in Harrisburg, PA

$3.8M committed

This property is a single-tenant office building in Harrisburg, PA serving as the main office for Dauphin County Children and Youth.

Total raise

$3.8M

Min Investment

$50K

Hold time

5 Years

LP IRR

20.25%

Return on equity

2.2 x

Get Notified About New Deals

Leave your email below and we'll notify you when new deals are added.