Liminal: Louisville's Premier Adaptive Reuse Opportunity

Deal Overview

Total Raise

$5.75M

Minimum Investment

$50K

Hold Period

6.5 Years

LP IRR

21.2%

Return on Equity

3.0x

Liminal is a transformative attainable housing investment opportunity that will revitalize a historic landmark into a mixed-use development in Louisville's burgeoning Portland neighborhood. This adaptive re-use project will convert a 137,000 SF riverfront warehouse into 138 workforce apartments and 5 vibrant commercial spaces, fostering a thriving community hub next to a new waterfront park.

Join Antecedent in creating a landmark development that delivers strong risk-adjusted financial returns and meaningful community impact in one of the country’s hottest multifamily markets.

Investment Highlights

- Target Returns: Projected 23.4% Project IRR / 21.2% LP IRR and 3.3x Project Equity Multiple / 3.0x LP Multiple.

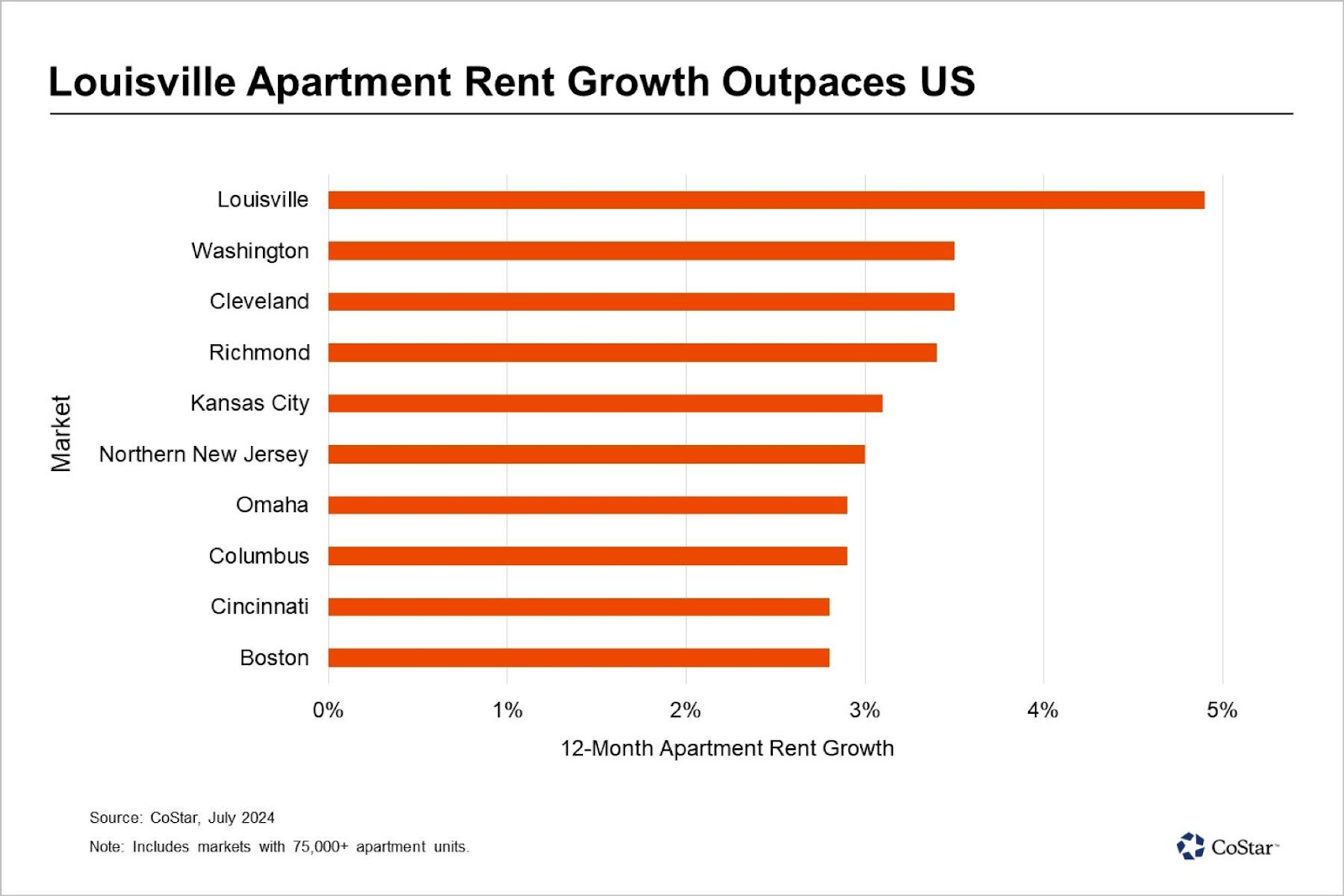

- White-Hot Market: CoStar ranked emerging Midwestern city Louisville 1st in year-over-year rent growth nationally in July 2024 and the city also boasted top-10 occupancy increases in 2023.

- Hard-To-Replicate Incentives: Utilizing ~$11M of historic tax credit equity and $2.2M in low-interest loans to minimize equity requirements and maximize returns. Property tax moratoriums also save Liminal ~$1M in operating expenses over the first five years.

- Robust Demand for Attainable Housing: Addressing Louisville's acute need for workforce housing, affordable to moderate-income workers earning ~80% of AMI. Nationwide market data shows that attainable housing boasts lower turnover and higher occupancies than market-rate housing. As such, it has become a preferred asset class for high-net-worth individuals, family offices, and institutional investors, creating a diverse pool of buyers for the completed project.

- Prime Location in a Revitalizing Neighborhood: Adjacent to the $50M Waterfront Park expansion with easy transit access to downtown entertainment, hospitals, and employment centers.

- Attractive Acquisition: Secured the 137,000 SF building for $20/SF, significantly below replacement cost and comparable properties.

- Green & Sustainable: Liminal teams adaptive reuse with operations technologies that enhance livability and sustainability. Louisville consistently ranks among the most climate resilient cities in the US' Top 50 MSAs.

- Experienced Team: Led by Antecedent, with local expertise from Co-Developers Gill Holland and Gregg Rochman, and a best-in-class design and construction team.

- Shovel Ready: Debt and equity financing in place but for this LP raise, with full entitlements and building permits expected in December.

- Pipeline Opportunities: For any LP investment over $150,000, Antecedent is offering the ability to invest in its GP for future pipeline projects.

Meet the Team

Antecedent is a commercial real estate firm working in rising mid-sized Southern and Midwestern markets. Antecedent brings decades of real estate development, investment, and finance experience, with particular expertise in adaptive reuse and leveraging incentives like historic tax credits and property tax moratoriums to amplify returns and decrease risk. Our projects deliver exceptional financial returns and have a positive social and environmental impact in the communities where we work.

Peter Goergen

Partner

Peter has spent over 15 years in commercial real estate, including as the Denver MD of Concord Summit, a capital markets advisory firm and investment fund. He served as a CFO of East West Partners where he led the development of the $1B Snowmass Village Project, and he began his career developing and financing historic tax credit projects.

MBA, Wharton, UPenn

BA, University of Virginia

Kappie Farrington

Partner

Kappie brings 14 years of place-making development experience. She helped found Co-Impact, a $700M impact investing fund that spun out of the Gates Foundation and Rockefeller Foundations. She also led an economic development portfolio at the Rockefeller Foundation.

MPA, Harvard

BA, University of Virginia

Co-Developers

Antecedent has partnered with two of Louisville's most respected developers, Gill Holland and Gregg Rochman, to bring construction expertise and deep community relationships to the Liminal project.

Gill Holland

Partner

Gill is one of Louisville's most transformative developers and was instrumental in creating the thriving arts/design and sustainable district known as "NuLu". Gill currently leads the investment and development firm, Portland Investment Initiative.

JD, BA, University of North Carolina

Gregg Rochman

Partner

Gregg works as an urban developer with a current focus on the Portland Neighborhood. Gregg owns and operates Rocklee, a construction management and owner's rep company, which is responsible for managing construction for many projects in Portland.

BA, SUNY Binghamton

Investment Timeline

Liminal is on track to close financing and begin construction in February 2025. The projected investment timeline is as follows:

- Q1 2025: Closing of LP investment and commencement of construction.

- June 2026: Construction completion.

- June 2027: Stabilization of apartment units and commercial spaces.

- 2027-2030: Ongoing operations.

- 2031: Projected sale of the property.

This timeline allows investors to participate in a well-structured project with a clear path to achieving strong returns while benefiting from the anticipated growth and continued revitalization of the Portland neighborhood.

Why Louisville? Why the Portland Warehouse District?

Louisville: A Rising Star in the Southeast

Louisville is experiencing a renaissance, driven by a robust economy, a low cost of living, and a high quality of life. This combination of factors has positioned the city as a prime location for real estate investment, particularly in the attainable/workforce housing sector. According to CoStar, Louisville ranked 1st nationally among the Top 50 MSAs in year-over-year rent increases in July 2024 and has seen Top-10 rent and occupancy growth since the beginning of 2023.

Portland: A Neighborhood on the Up

Liminal is strategically located in the heart of Portland, a neighborhood brimming with potential and undergoing a remarkable transformation. Fueled by over $181 million of public and private investment in recent years, Portland now has a host of new multifamily, retail, hospitality, and cultural attractions, creating a vibrant and walkable community.

Louisville's Waterfront Park expansion is bringing miles of trails, playgrounds, and greenspace to Liminal's front door.

Key Location Advantages:

- Unparalleled Proximity to Downtown and Waterfront Park: Liminal is just a short walk from downtown Louisville and the city's acclaimed $50M Waterfront Park expansion, providing residents with easy access to employment centers, entertainment, recreation, and greenspace.

- Historic Charm and Private Investment: Located in the heart of the Portland Warehouse District, Liminal is surrounded by beautiful historic buildings that are being converted into unique residential, commercial, and cultural spaces. Over $117M has been privately invested in recent years, including in the highly successful Painter's Row multifamily project across the street from Liminal.

- Strong Market Fundamentals: Louisville's multifamily market is experiencing nation-leading rent and occupancy growth, with demand fueled by population growth and a shortage of housing options, especially at the attainable price point. Liminal's rents are projected to be significantly below market rates (affordable to families making 80% of Area Median Income), ensuring strong lease up, occupancy, and attractive returns.

- Public Investment and Infrastructure Improvements: By investing in significant public works projects, the City of Louisville has committed to the revitalization of Portland. The $50M expansion of Waterfront Park will connect to Liminal's front door via a pedestrian bridge, and the city is transforming the entrance to Portland by converting Main Street from one-way traffic to a two-way street with protected bike lanes.

Liminal's strategic location in the Portland Neighborhood positions it at the forefront of Louisville's growth and revitalization, offering investors a unique opportunity to capitalize on a dynamic and evolving market.

Why This Investment?

Liminal represents a compelling investment opportunity for investors seeking strong risk-adjusted returns and positive community impact. Here's why:

- Strong Returns Driven by Multiple Value Drivers: Liminal's impressive projected returns are supported by a confluence of factors, including historic tax credits, low-interest loans, a favorable acquisition basis, and strong demand for attainable housing. This is despite conservatively underwriting rents well below 80% AMI and projecting only 3% rent growth in a rapidly revitalizing neighborhood.

- Early Mover Advantage in a High-Growth Market: Portland's transformation is just beginning, and Liminal is positioned to benefit from the continued influx of investment and the neighborhood's growing appeal to residents and businesses.

- Experienced Team with Local Expertise: Antecedent's team is headquartered in Louisville and has a proven track record developing and financing complex real estate projects. Their partnership with local developers, architects, and contractors ensures a deep understanding of the Louisville market and Portland community.

- Mission-Driven Development with a Triple Bottom Line: Liminal is not just about financial returns; it's about creating a vibrant community hub that provides attainable housing, supports local businesses, and prioritizes sustainability and environmental responsibility.

- Limited Opportunity to Participate in a Transformative Project: This is a unique chance to invest in a shovel-ready project that will have a lasting impact on the Portland neighborhood, while generating attractive returns for investors.

Investing in Liminal is an opportunity to be part of a compelling story – a story of revitalization, community building, and financial success.

Project Financial Details

Sources and Uses

| Sources | $ Amt | % Per RSF |

| Construction Loan | $17,210,000 | 47% |

| HTC Equity | $10,996,272 | 30% |

| Developer & LP Equity | $6,048,014 | 16% |

| Deferred Developer Fee | $2,498,674 | 7% |

| Brownfields Reimbursement | $150,000 | 0% |

| Total Sources | $36,902,959 | 100% |

| Uses | $ Amt | % Per RSF |

| Land Acquisition | $3,895,840 | 11% |

| Closing, Legal, Accounting | $558,264 | 2% |

| Soft Costs | $4,713,871 | 13% |

| Site Work | $590,656 | 2% |

| Building Hard Costs | $23,135,867 | 63% |

| Tenant Improvements | $563,910 | 2% |

| Financing Costs | $3,444,552 | 9% |

| Total Uses | $36,902,959 | 100% |

NOTE: The returns and peak equity amounts above are calculated from the date at which the LP invests in the project & Antecedent concurrently acquires the 1416-1426 Lytle Street warehouse, 1403-1405 Rowan Street parking lot & commercial building, and starts construction.

Sensitivity Analysis

The following analysis shows how different exit cap rates and rental rates could impact project returns:

| Project Return Sensitivity: Cap Rate & Rent Case | |||

|---|---|---|---|

| Low Rent ($1,189) |

Med. Rent ($1,239) |

High Rent ($1,289) |

|

| 4.50% | 27.7% / 4.1x | 29.8% / 4.5x | 31.9% / 4.9x |

| 5.00% | 24.2% / 3.5x | 26.5% / 3.8x | 28.6% / 4.2x |

| 5.50% | 21.0% / 3.0x | 23.4% / 3.3x | 25.6% / 3.6x |

| 6.00% | 17.9% / 2.5x | 20.4% / 2.8x | 22.7% / 3.2x |

| 6.50% | 14.8% / 2.2x | 17.5% / 2.5x | 20.0% / 2.8x |

Note: Returns shown as Project IRR / Equity Multiple. Base case highlighted in gray.

Proven Track Record: Delivering Successful Projects

The Liminal project brings together a team with extensive experience in real estate development, finance, and construction, particularly in the realm of historic renovations and adaptive reuse. This combined expertise ensures a solid foundation for the project's success.

Antecedent's principals have a proven track record:

- Developing and financing complex real estate projects: Including large-scale, $1B developments like Snowmass Base Village near Aspen, CO, and transformative historic-tax-credit projects like the Coca Cola Building and the CFA Institute HQ in Charlottesville, VA.

- Working with historic tax credits: Antecedent's principals have a deep understanding of the intricacies of historic tax credit financing and have successfully utilized this tool in previous developments.

Martha Jefferson Hospital renovation into CFA Institute Global HQ - a former project led by Antecedent's principals.

Co-Developers Gill Holland and Gregg Rochman add:

- Deep understanding of the Louisville market: Their experience and connections within the city, particularly in the Portland neighborhood, bring invaluable local expertise to the project.

- Successful track records transforming historic buildings: Projects such as Painter's Row, the University of Louisville's Hite Art Institute, Heine Brothers Headquarters, and the Green Building showcase their expertise in adaptive reuse and construction oversight.

The Painter's Row project across the street from Liminal, co-developed by Gill Holland and Gregg Rochman

Completing the team are experts in design and construction:

- Work Architecture + Design: Liminal's architectural firm, known for their award-winning work on adaptive reuse projects like Louisville's Bradford Mills Lofts.

- Weber Group: A respected regional general contractor with experience in both multifamily and historic renovation projects, including the recently completed Painter's Row across the street from Liminal.

This collective experience ensures Liminal will be developed and executed with the highest level of expertise, setting the stage for a successful project that benefits both the community and investors.

Invest in Liminal: Louisville's Premier Adaptive Reuse Opportunity

Total raise

$5.75M

Min Investment

$50K

Hold time

6.5 Years

LP IRR

21.2%

Return on equity

3.0x

↓ More details available to qualified investors ↓

Similar Investment Opportunities

Explore more premium deals in our curated collection

The Benton: Class-A Multifamily Near Walmart HQ

$85K committed

The Benton is a strategically positioned 150-unit multifamily housing complex located less than 10 minutes from the new Walmart Corporate headquarters in Northwest Arkansas. This investment opportunity capitalizes on the region's strong economic growth and high demand for quality housing.

Total raise

$8.5M

Min Investment

$100K

Hold time

5-7 Years

LP IRR

19%-22%

Return on equity

1.9 x

Stable Government-Leased Office Investment in Harrisburg, PA

$3.8M committed

This property is a single-tenant office building in Harrisburg, PA serving as the main office for Dauphin County Children and Youth.

Total raise

$3.8M

Min Investment

$50K

Hold time

5 Years

LP IRR

20.25%

Return on equity

2.2 x

Get Notified About New Deals

Leave your email below and we'll notify you when new deals are added.