Horizon Apartments: Cashflowing Multifamily in San Antonio

Deal Overview

Total Raise

$6.6M

Minimum Investment

$50K

Hold Period

5 Years

LP IRR

18%

Return on Equity

2.1x

Horizon Apartments is a 204-unit multifamily community in San Antonio, TX. This cashflowing asset presents an opportunity for accredited investors to participate in a value-add strategy targeting an 18% IRR and 2.1x equity multiple.

Executive Summary

Horizon Apartments is a 204-unit multifamily community located in the rapidly growing Northeast San Antonio submarket. This well-maintained workforce housing asset offers investors an attractive opportunity with stable cash flow and significant upside potential. Investors are buying into a cash-flowing property where their money starts working immediately, as significant improvements in NOI and heavy lifting on CapEx have already been completed. The property benefits from a favorable loan assumption with a low, fixed interest rate and long-term maturity, providing a secure foundation for the investment. Our value-add strategy focuses on targeted renovations, improved management, and enhanced curb appeal to maximize rents and increase net operating income.

Key Highlights

- Assumable Fannie Mae Loan at 3.78% fixed rate, maturing in 2032

- Projected 18%+ IRR and 2.1x Equity Multiple

- Minimum Investment: $50,000

- 506c Offering for Accredited Investors

- Purchase Price: $16,900,000 ($82k/door)

Investment Highlights

Key Investment Highlights:

- High-Growth Market: Located in San Antonio, a market experiencing rapid growth and strong demand for multifamily housing.

- Attractive Basis: Purchased at a competitive price of $82,800 per unit, well below replacement cost.

- Stable Financing: Assumable loan at a favorable fixed interest rate of 3.78% with a maturity date in 2032.

- Value-Add Potential: Opportunity to increase rents and NOI through strategic renovations and improved management.

- Experienced Sponsor: Massive Capital has a successful track record of acquiring, managing, and repositioning multifamily assets.

- Tax Benefits: Investors benefit from depreciation and other tax advantages associated with real estate investments.

- Cash Flowing Asset: Property generates immediate cash flow with potential for increased distributions over time.

Invest $250K+ and Earn a 10% Bonus! Limited Time Offer

Sponsor Team

The Horizon Apartments investment is led by Massive Capital, a real estate investment firm with a proven track record of success in identifying and executing profitable real estate projects. Our team brings extensive experience in acquisitions, asset management, and investor relations, ensuring a transparent and efficient investment process.

Sanjay Aggarwal

Principal

Principal at Massive Capital with 8+ years as an active investor across asset classes (Land/SFR/Commercial/Multifamily). Co-sponsored 1000+ units across Texas with an exit of 800+ units. 10+ years in Fortune 50 Companies (Capital One/Barclays) with numerous leadership roles in Portfolio and Strategy and Vendor Relationship.

MBA from Booth School of Business (University of Chicago)

Masters in Mechanical Engineering from University of Central Florida

Shahriar Khan

Principal

Principal at Massive Capital with 7+ years as an active investor purchasing over 180+ properties across asset classes (Land/SFR/Commercial/Multifamily). Co-sponsor for 1,300+ Units. 16+ years at Royal Dutch Shell with numerous leadership roles in Engineering, Corporate Planning, Portfolio Strategy and Business Unit Finance Manager (CFO) looking over $1B+ of portfolio value.

MBA from Jones School of Business (Rice University)

Undergraduate in Electrical Engineering from Prairie View A&M University

Mike Bailey

Principal

Principal at Massive Capital with 20+ years as an active investor across asset classes (Land/SFR/Commercial/Multifamily). Co-sponsored 300+ units across the Houston and Dallas market since 2021. 30+ years in Fortune 10 company (ConocoPhillips) with numerous leadership roles in Upstream Engineering managing projects across multiple counties, Corporate Capital Strategy, and Vendor Relationship.

Bachelor of Science in Petroleum Engineering from the University of Oklahoma

Property & Location Overview

Horizon Apartments is a 204-unit multifamily property built in 1974 and situated on a sprawling 6.65-acre lot in Northeast San Antonio, Texas, just off the I-35 corridor. This well-maintained workforce housing community offers a mix of one and two-bedroom units, catering to a diverse range of residents. Recent renovations totaling $1 million have enhanced the property's appeal and positioned it for future rent growth.

- Units: 204 (One and Two-Bedroom)

- Total Square Footage: 177,786 sq ft

- Average Unit Size: 870 sq ft

- Occupancy: 96% (at acquisition)

Strategic Location in Northeast San Antonio

Horizon Apartments enjoys a prime location in Northeast San Antonio, a rapidly growing area with high demand for quality workforce housing. The property's proximity to major employers, including HEB Distribution Center, Frito Lay, Amazon, Caterpillar, Pepsi, and others, ensures a consistent pool of potential tenants. Its location also offers easy access to major highways, retail centers, hospitals, and the San Antonio International Airport, providing added convenience for residents.

The I-35 corridor between Austin and San Antonio, where the property is situated, is experiencing substantial growth and is projected to house between 6 and 7 million people by 2030, representing a significant driver of future demand and value appreciation.

Business Plan

Our business plan for Horizon Apartments is built on a strategic, phased approach designed to maximize returns for our investors. We are focused on implementing operational efficiencies, capital improvements, and targeted marketing strategies to achieve stabilization and position the property for a successful exit within a 5-year timeframe.

Phase 1: Stabilization (First 120 Days) - Completed

- Transition to new property management company

- Address deferred maintenance and implement initial capital improvements

- Focus on tenant retention and attracting high-quality residents

- Refine marketing and leasing strategies to optimize occupancy and rental rates

Phase 2: Pro-Forma Target (Year 1) - Ongoing

- Implement RUBs (Rental Unit Upgrades) and introduce a cable package for additional other income

- Gradually increase rents towards market rates

- Improve lead generation and conversion processes through enhanced marketing and staff training

Phase 3: Optimization (Year 2)

- Maximize rental income by achieving market rents on renovated units

- Increase other income streams through storage rentals and other ancillary services

- Maintain low vacancy rates (under 5%) and minimize delinquencies/bad debts (~4%)

- Implement low-cost, high-impact interior and exterior improvements to enhance curb appeal

Phase 4: Cap Rate Alignment (Years 3-5)

- Sustain market rents and residential income growth

- Control expenses and optimize operational efficiency

- Monitor market cap rates and prepare for a strategic exit by Year 5

Capital Improvements:

Our planned capital improvements will focus on enhancing the property's curb appeal, modernizing unit interiors, and adding value-enhancing amenities. Key projects include:

- Pool resurfacing and furniture upgrades - Completed

- Exterior signage and branding updates - Completed

- Parking lot repairs and striping - Completed

- Building 1 roof replacement - Completed

- Parcel locker installation - Completed

- Interior unit renovations (select units) - Ongoing

- Exterior wood fencing - Completed

Sources and Uses

| Investment Summary | |

|---|---|

| Purchase Price | $16,900,000 |

| Loan Down Payment | $4,175,500 |

| Capital Improvement Budget | $1,164,663 |

| Closing Costs & Acquisition Fees | $591,500 |

| Operating Reserves | $668,337 |

| Total Capitalization | $6,600,000 |

| Financing Terms | Loan Assumption | Supplemental |

|---|---|---|

| Loan Type | Fannie Mae | Fannie Mae |

| Amortization | 30 years (from 2020) | 30 years (from 2020) |

| Loan Amount | 75% LTV | $2,574,000 |

| Interest Rate | 3.78% | 8.24% |

| Interest Only | None | None |

| Loan Term | 8 years remaining | 8 years remaining |

Estimated blended interest rate: 4.68%

Exit Strategy

Our exit strategy for Horizon Apartments targets a sale within a 5-year timeframe. The 7-year fixed-rate financing allows flexibility in aligning the sale with market cycles and achieving optimal returns.

Target Sale Year: Year 5

Key factors driving our exit strategy:

- Achieve a Net Operating Income (NOI) exceeding $1.59 million annually.

- Secure a favorable cap rate at or below 6%.

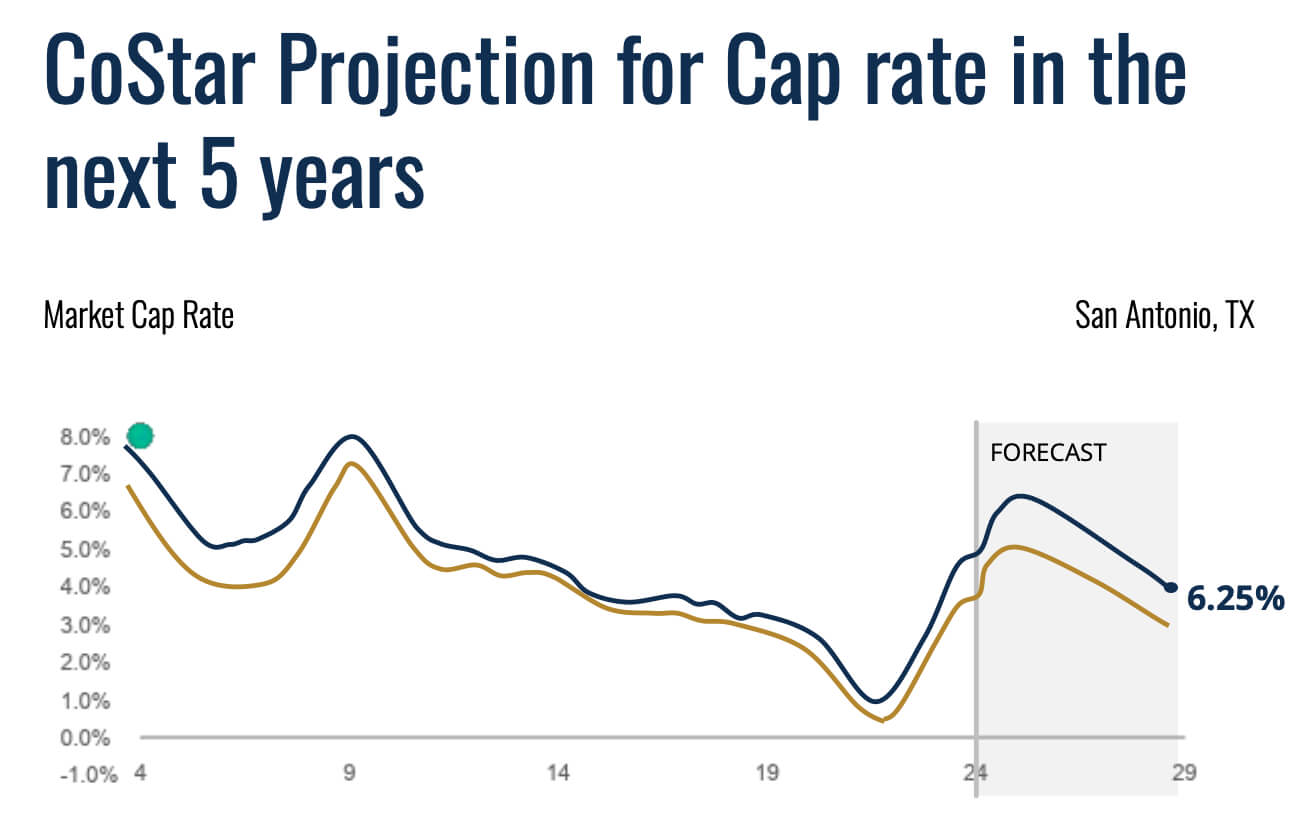

CoStar's 5-Year Cap Rate Projection

Cap Rate Compression and Decompression Sensitivity Analysis

| Cap Rate / NOI | Year 3 | Year 4 | Year 5 |

|---|---|---|---|

| NOI | $1,482,848 | $1,540,322 | $1,599,780 |

| 5.75% | $25,788,655 | $26,788,206 | $27,822,261 |

| 6.00% | $24,714,128 | $25,672,031 | $26,663,001 |

| 6.25% | $23,725,563 | $24,645,149 | $25,596,480 |

| 6.50% | $22,813,041 | $23,697,259 | $24,612,000 |

Projected Returns at Exit in Year 5

| Sale End of Year | 5 |

|---|---|

| Net Operating Income NOI | $1,599,780 |

| Cap Rate at Sale | 6.00% |

| Sale Price | $26,663,001 |

| Sale Price per Door | $130,701 |

| Sale Costs less Reserves/Escrow | ($1,333,150) |

| Outstanding Loan Balance | ($11,596,441) |

| Total Sale Proceeds | $13,733,410 |

| Remaining Equity Basis | ($6,600,000) |

| Capital Transaction Fee to Mgr | ($399,945) |

| Remaining proceeds available | $6,733,465 |

| Net Proceeds Paid to Class A Members / LP | $4,713,426 |

| Net Proceeds Paid to Class B Mgr Share / GP | $2,020,040 |

Invest in Horizon Apartments: Cashflowing Multifamily in San Antonio

Total raise

$6.6M

Min Investment

$50K

Hold time

5 Years

LP IRR

18%

Return on equity

2.1x

↓ More details available to qualified investors ↓

Similar Investment Opportunities

Explore more premium deals in our curated collection

Flagship Vineyard Resort in Paso Robles: Sona Hills

$30M committed

A flagship 56-key luxury boutique vineyard resort under development in Paso Robles, CA. Spanning 220 acres, the project includes villas (fractional), suites, restaurants, tasting room, wine making facility, spa & wellness center, event spaces, and more. Investors benefit from a compelling returns...

Total raise

$30M

Min Investment

$250K

Hold time

10 Years

LP IRR

32.73%

Return on equity

3.0 x

Stabilized Multifamily in Naples, FL with Conversion Upside

$0 committed

Jade at Olde Naples is a 104-unit multifamily community in Naples, FL, offering a stabilized investment opportunity with upside potential. This well-maintained property is located in Naples, FL, ranked #1 for the 2024-2025 best places to live by US News and World Report and benefits from high bar...

Total raise

$8.55M

Min Investment

$100K

Hold time

3-5 Years

LP IRR

22.2%

The Benton: Class-A Multifamily Near Walmart HQ

$85K committed

The Benton is a strategically positioned 150-unit multifamily housing complex located less than 10 minutes from the new Walmart Corporate headquarters in Northwest Arkansas. This investment opportunity capitalizes on the region's strong economic growth and high demand for quality housing.

...Total raise

$8.5M

Min Investment

$100K

Hold time

5-7 Years

LP IRR

19%-22%

Return on equity

1.9 x

Stable Government-Leased Office Investment in Harrisburg, PA

$3.8M committed

This property is a single-tenant office building in Harrisburg, PA serving as the main office for Dauphin County Children and Youth.

...Total raise

$3.8M

Min Investment

$50K

Hold time

5 Years

LP IRR

20.25%

Return on equity

2.2 x

Liminal: Louisville's Premier Adaptive Reuse Opportunity

$5.75M committed

Liminal is a transformative attainable housing investment opportunity that will revitalize a historic landmark into a mixed-use development in Louisville's burgeoning Portland neighborhood. This adaptive re-use project will convert a 137,000 SF riverfront warehouse into 138 workforce apartments ...

Total raise

$5.75M

Min Investment

$50K

Hold time

6.5 Years

LP IRR

21.2%

Return on equity

3.0 x

Green Bay's NOVA: Class-A Multifamily with 20.1% Target LP IRR

$1M committed

NOVA is a new 8-story, Class A, mixed-use multifamily development located at 221 Cherry Street in Green Bay, Wisconsin. The project features 268 units with an average size of 802 SF, approximately 5,000 SF of commercial space, and offers a unique opportunity in the growing Green Bay market.

...Total raise

$12.8M

Min Investment

$87.08K

Hold time

5 Years

LP IRR

20.1%

Return on equity

2.7 x

Onicx Healthcare Real Estate Fund: Capitalizing on the Growing Demand for Medical Real Estate

$50M committed

The fund will be investing in outpatient medical assets with value-add acquisitions and ground-up developments primarily in the Southeast. Onicx is vertically integrated with its own construction and property management teams and has over 20 years of track record in the space.

...Total raise

$50M

Min Investment

$100K

Hold time

3-5 Years

LP IRR

15%-19%

Get Notified About New Deals

Leave your email below and we'll notify you when new deals are added.