Onicx Healthcare Real Estate Fund: Capitalizing on the Growing Demand for Medical Real Estate

Deal Overview

Total Raise

$50M

Minimum Investment

$100K

Hold Period

3-5 Years

LP IRR

15%-19%

The fund will be investing in outpatient medical assets with value-add acquisitions and ground-up developments primarily in the Southeast. Onicx is vertically integrated with its own construction and property management teams and has over 20 years of track record in the space.

- Target Fund Size

$50 million in total capital commitments to develop / acquire $125-175 million in real estate assets - GP Investment

$2.5 million (5% of Fund equity) - Investor Classes

Class A Investors: $2,000,000 or greater

Class B Investors: $100,000 up to $2,000,000 - Target Returns

Class A Investors: Mid-to-high-teens internal rate of return (net of fees and carried interest)

Class B Investors: Mid teens internal rate of return (net of fees and carried interest)

Executive Summary

- Onicx Healthcare Real Estate Fund (the "Fund") is seeking a $50 million capital commitment to develop and acquire medical office buildings.

- The fund will be investing in outpatient medical assets with value-add acquisitions and ground-up developments primarily in the Southeast.

- Onicx is vertically integrated with its own construction and property management teams and has over 20 years of track record in the space.

- The Fund will directly invest in the projects, and Onicx principals will invest 5% of total Fund equity and provide loan / construction guaranties where necessary.

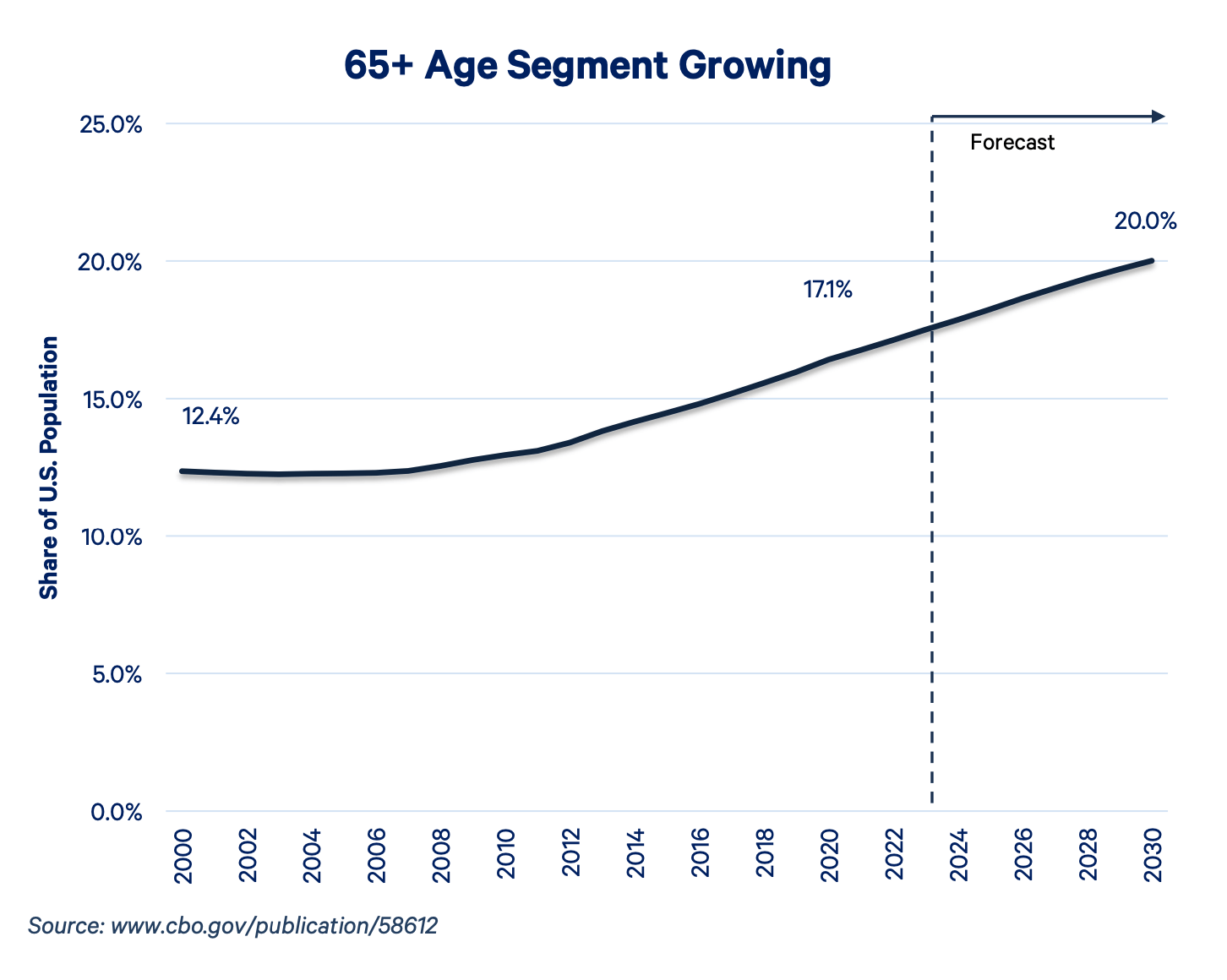

- The Fund will capitalize on high demand medical office buildings as a result of the aging population trend and the ongoing shift in healthcare delivery to outpatient settings.

- The Fund investment period will be approximately 3-5 years

Meet the Team

Dhvanit Patel

President / CEO

Ali Wald

COO

Jag Singh Obhan

Chief Financial Officer

Connor T. Lewis

EVP of Healthcare Development

Arjun Choudhary

VP of Investments

Ilya Hvostikov

VP of Acquisitions

Scott Hutchison

VP of Construction

Glenn Preston

Executive Advisor

Sponsor Overview

Onicx Group ("Onicx"), headquartered in Tampa, is an established multi-asset developer focused on healthcare with experience in multifamily, industrial, and mixed-use commercial real estate. Onicx is a prominent healthcare real estate developer and a trusted real estate partner for health systems and physician practices, with a longstanding focus in healthcare real estate and an unparalleled sector knowledge.

Over the course of 20 years, Onicx has developed over 3 million square feet of commercial real estate, completed on time and budget. Notably, 70% of the healthcare transactions are for existing relationships, an endorsement from its noteworthy clients. With an average executive management tenure of more than 9.5 years and a consistent high tenant satisfaction rate, the success of Onicx's platform bodes well both internally and externally. The management team has a cumulative experience of 100 years in development, finance, construction, and investor relations.

Onicx's full-service platform provides an array of services related to strategy, execution and operations. Highlighted among them are feasibility analysis, site selection, development, design, construction, acquisitions, leasing and property management. Onicx Group has an in-house construction company which allows Onicx to control the entire development cycle of the property. This is a key differentiator from traditional developers that outsource construction.

Why Invest in Healthcare Real Estate?

- Stable and growing sector driven by demographic trends

- Resilient asset class with high occupancy rates

- Long-term leases with creditworthy tenants

- Steady cash flows with built-in rent escalations

- Recession-resistant industry

- Potential for value-add opportunities through property improvements and operational efficiencies

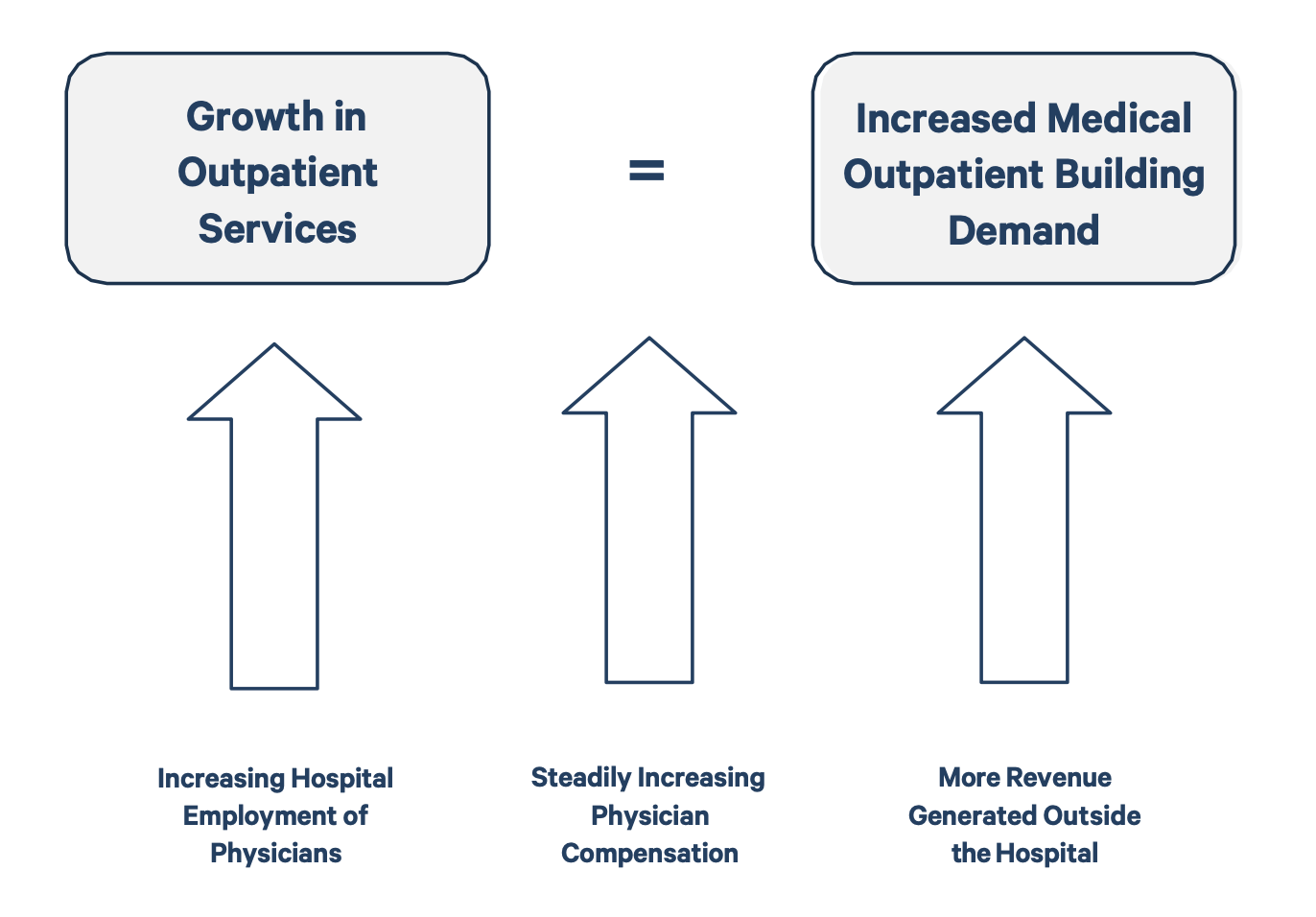

Market Opportunity

- MOB sector expanding due to healthcare system shifts

- 65+ population projected to be 20% of total by 2028

- 92% average occupancy in medical properties vs 82% in traditional office

- High tenant retention with 81%+ average lease renewal rates

- Long-term leases (10-20 years) with 2-4% annual escalations

- Outpatient visit growth has outpaced inpatient visits by 85% since 1995

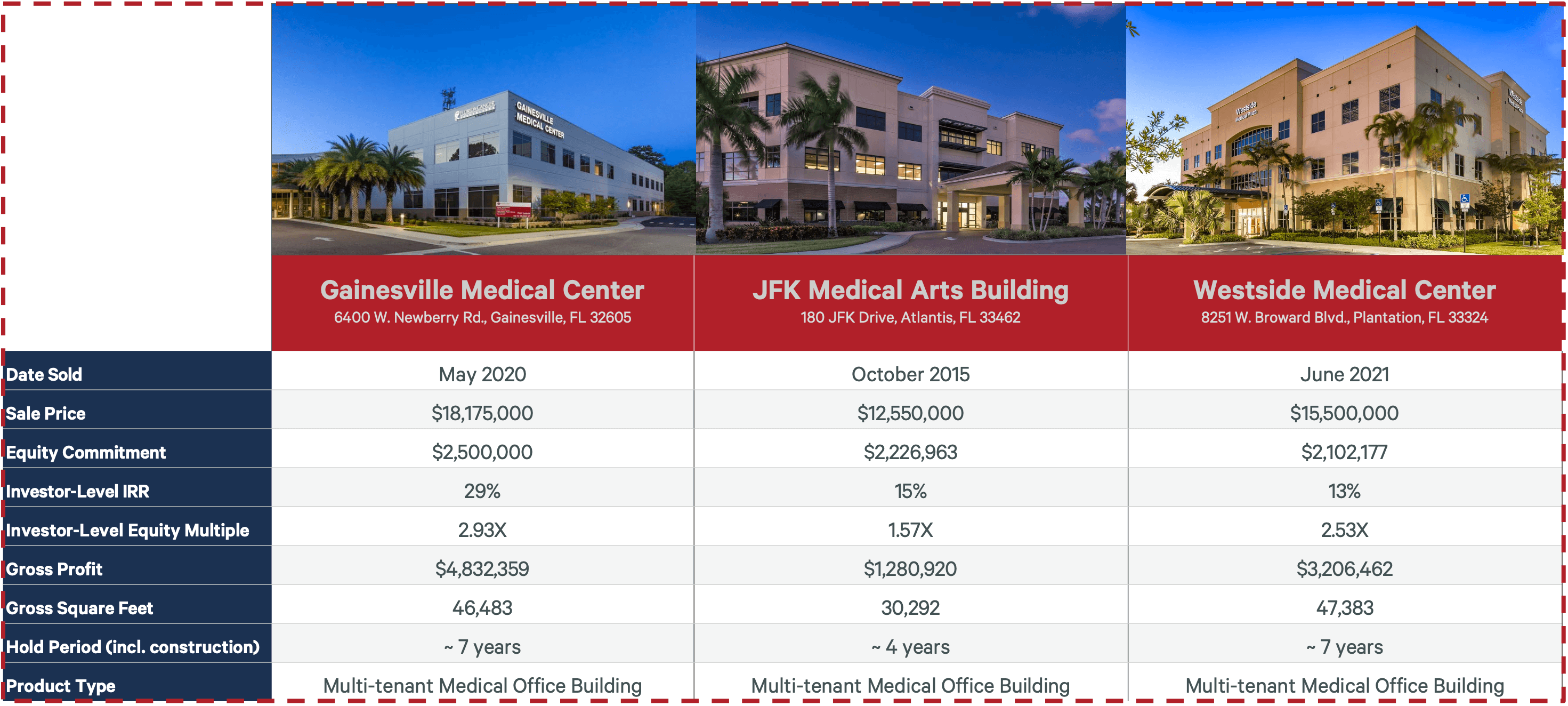

Proven Track Record

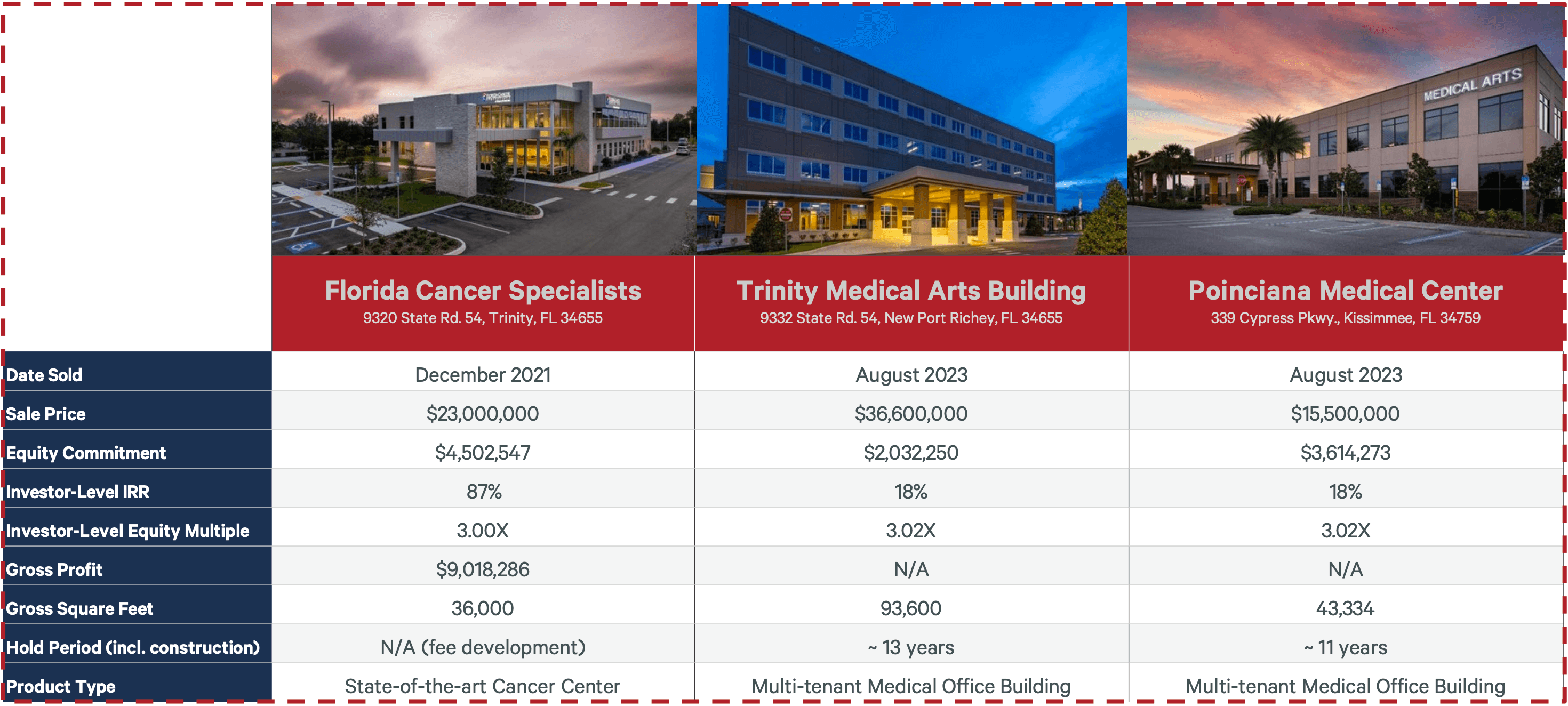

Onicx Group has demonstrated a strong track record of successful full cycle developments in the healthcare real estate sector. Here are some notable projects:

These projects showcase Onicx's ability to deliver strong returns across various types of medical office buildings and healthcare facilities, with investor-level IRRs ranging from 13% to 87% and equity multiples consistently above 1.5x.

Current Investments

- Lafayette MOB: 25,000 SF acquisition, Purchasing in September 2024, Est. IRR 18-20%+

- Trinity Oaks MOB: 31,000 SF acquisition, Purchasing in October 2024, Est. IRR 15-17%+

- Jacksonville Seven Pines MOB: 50,000 SF development, Estimated Delivery by Q1 2026, Est. IRR 17-19%+

Development Pipeline

| Project | Size (SF) | Dev. Cost | Est. ROC | Construction Period |

|---|---|---|---|---|

| HCA Trinity II | 60,000 | $27M | 7.6% | Q3 2024 - Q3 2025 |

| Jacksonville MOB | 50,000 | $26M | 7.3% | Q4 2024 - Q4 2025 |

| HCA Trailwinds | 50,000 | $23M | 7.5% | Q1 2025 - Q1 2026 |

| HCA Gainesville | 50,000 | $20M | 7.2% | Q2 2025 - Q2 2026 |

Investment Strategy

- Target outpatient medical assets with value-add acquisitions and ground-up developments

- Primary location: Southeast United States

- Capitalize on high demand for medical office buildings due to aging population and shift to outpatient care

- Leverage Onicx's vertically integrated platform with in-house construction and property management

Distribution Waterfall

Both Class A and B investors receive:

- Repayment of debt and accrued interest

- Repayment of member loans and accrued interest

- Return of member capital plus 9% Preferred Return

- Cash flow split: 80% to members / 20% to Onicx until 12% return is achieved

After 12% return:

- Class A: 70% to members / 30% to Onicx

- Class B: 60% to members / 40% to Onicx

Invest in Onicx Healthcare Real Estate Fund: Capitalizing on the Growing Demand for Medical Real Estate

Total raise

$50M

Min Investment

$100K

Hold time

3-5 Years

LP IRR

15%-19%

↓ More details available to qualified investors ↓

Similar Investment Opportunities

Explore more premium deals in our curated collection

Franklin Square: A JV Value-Add Retail Opportunity

$0 committed

Join AVGI in the acquisition of a well-situated, 10-tenant retail strip center located on a major thoroughfare in Long Island. This 16,000 SF property in the highly desirable Franklin Square, NY market presents a clear value-add opportunity.

Total raise

$3M

Min Investment

$3M

Hold time

5 Years

LP IRR

17.11%

Return on equity

2.1 x

Portland's Belmont Middle Housing: High-Return Multifamily

$0 committed

Jacobsen Development Group’ ground-up, Class A, boutique multifamily development in Portland, Oregon, adds 25 market-rate units to the city’s highly desirable Belmont neighborhood. The investment directly caters to the housing demand in this walkable, amenity-rich area near major employment centers.

Total raise

$2.08M

Min Investment

$50K

Hold time

5 Years

LP IRR

18.16%

Return on equity

2.2 x

Multi-Tenant Retail Development: Roanoke Village Pad 1

$1M committed

RVTX Partners, LLC is a joint venture sponsored by three seasoned development firms—Urbana Holdings, MTX Hospitality, and VTP Capital Partners. Investors have the opportunity to participate in the ground-up development of Roanoke Village Pad 1, a multi-tenant retail asset located in the growing market of Roanoke, TX. This project is part of the larger Roanoke Village mixed-use development and seeks $1 million in Limited Partner (LP) equity, which will be complemented by over $830,000 in sponsor equity to fully capitalize the development of Pad 1. With 37% of the leasable area pre-committed to D1 Training and strong tenant demand in the area, this investment offers a compelling risk-adjusted return profile, projecting:

Total raise

$1M

Min Investment

$50K

Hold time

On Request

LP IRR

20.2%

Return on equity

1.6 x

The Approach: Class A Multifamily

$0 committed

The Approach is a Class A, 318-unit multifamily development located in Westfield, Indiana — one of the fastest-growing cities in the state and a leading market for multifamily investment. Investors are projected to receive a 25% internal rate of return (IRR) over the three-year investment period, with an equity multiple of 1.9x.

Total raise

$6M

Min Investment

$250K

Hold time

3 Years

LP IRR

25%

Return on equity

1.9 x

Medical Office Building - Cash Flowing Asset with Capital Growth Potential

$0 committed

Tidegate Capital presents an opportunity to invest in a Class A Medical Office Building (MOB) located in Richmond, Virginia. This offering provides a stable, cash-flowing asset with significant capital growth potential in a prime medical district.

Total raise

$500K

Min Investment

$50K

Hold time

7 Years

LP IRR

18%

176-Unit Multifamily Investment Opportunity in Atlanta, GA

$10B committed

The Broadway at East Atlanta presents a unique value-add multifamily investment opportunity in a high-growth Atlanta submarket. The property benefits from a low basis acquisition price with proven operational upside, making it an attractive proposition for investors looking for strong cash flow and long-term appreciation.

Total raise

$7.83M

Min Investment

$100K

Hold time

5 Years

LP IRR

17%

Return on equity

2.0 x

Ground-Up Opportunity in Arizona: Permit-Ready Mesa Hotel

$50K committed

Invest in the ground-up development of a 107-room upscale Cambria Hotel in Mesa, AZ. This permit-ready project in the Mesa Tech Corridor, by Aspect Hospitality Group and O'Reilly Hospitality Management, offers a 23.2% projected IRR, 19% cash-on-cash yield, and ownership in a premium, branded hotel in a booming market with strong demand drivers.

Total raise

$5M

Min Investment

$100K

Hold time

5-10 Years

LP IRR

23.2%

Return on equity

3.4 x

Flagship Vineyard Resort in Paso Robles: Sona Hills

$30M committed

A flagship 56-key luxury boutique vineyard resort under development in Paso Robles, CA. Spanning 220 acres, the project includes villas (fractional), suites, restaurants, tasting room, wine making facility, spa & wellness center, event spaces, and more. Investors benefit from a compelling returns profile and the chance to shape a new standard of wine-country luxury.

Total raise

$30M

Min Investment

$250K

Hold time

10 Years

LP IRR

32.73%

Return on equity

3.0 x

The Benton: Class-A Multifamily Near Walmart HQ

$85K committed

The Benton is a strategically positioned 150-unit multifamily housing complex located less than 10 minutes from the new Walmart Corporate headquarters in Northwest Arkansas. This investment opportunity capitalizes on the region's strong economic growth and high demand for quality housing.

Total raise

$8.5M

Min Investment

$100K

Hold time

5-7 Years

LP IRR

19%-22%

Return on equity

1.9 x

Stable Government-Leased Office Investment in Harrisburg, PA

$3.8M committed

This property is a single-tenant office building in Harrisburg, PA serving as the main office for Dauphin County Children and Youth.

Total raise

$3.8M

Min Investment

$50K

Hold time

5 Years

LP IRR

20.25%

Return on equity

2.2 x

Get Notified About New Deals

Leave your email below and we'll notify you when new deals are added.